In today's competitive business landscape, understanding the intricacies of profitability is crucial for success. One key metric that stands out in this realm is contribution margin – a powerful financial tool that provides invaluable insights into a company's operational efficiency and profit potential. This comprehensive guide will explore the world of contribution margin in depth, covering its definition, significance, calculation methods, and practical applications in modern business strategy.

What is Contribution Margin?

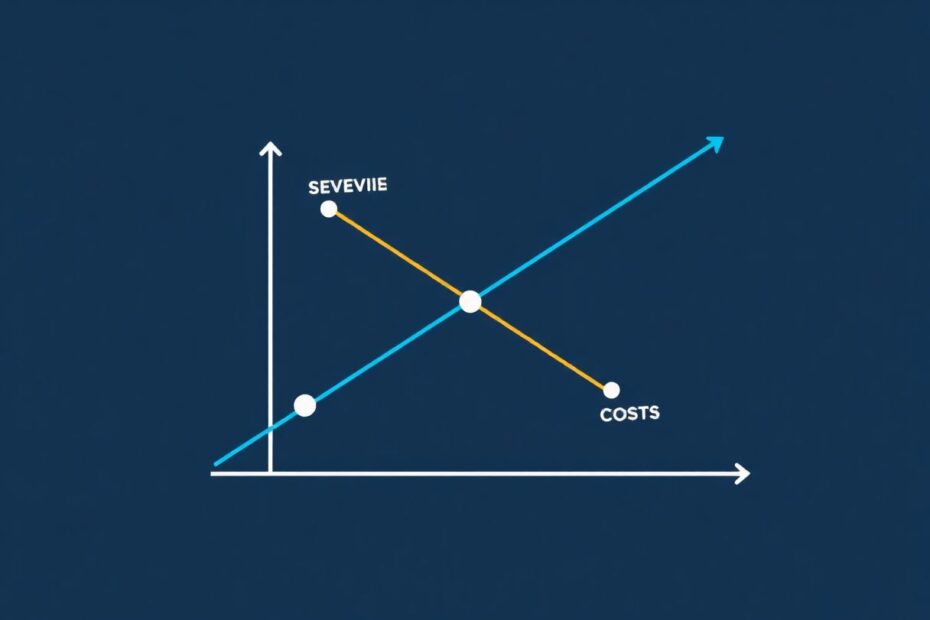

Contribution margin represents the portion of sales revenue that remains after deducting variable costs associated with producing a product or delivering a service. This leftover amount "contributes" to covering fixed costs and ultimately generating profit for the business.

The basic formula for calculating contribution margin is:

Contribution Margin = Total Sales Revenue - Total Variable Costs

This can also be expressed as a percentage or ratio:

Contribution Margin Ratio = (Total Sales Revenue - Total Variable Costs) / Total Sales Revenue

Understanding contribution margin is crucial because it:

- Helps inform pricing decisions

- Guides product mix strategies

- Assists in break-even analysis

- Supports cost control efforts

- Facilitates profitability comparisons across products or services

Components of Contribution Margin

To fully grasp the concept of contribution margin, it's essential to understand its key components:

Sales Revenue: The total income generated from selling products or services before any deductions.

Variable Costs: Expenses that fluctuate directly with production volume or sales. Examples include:

- Raw materials

- Direct labor

- Sales commissions

- Packaging

- Shipping costs

Fixed Costs: While not part of the contribution margin calculation itself, fixed costs play a crucial role in overall profitability. These are expenses that remain constant regardless of production or sales volume, such as:

- Rent

- Salaries

- Insurance

- Depreciation

Practical Example: Calculating Contribution Margin

Let's illustrate the concept with a simple example:

Imagine a company that sells custom t-shirts:

- Selling price per shirt: $25

- Cost of materials per shirt: $10

- Labor cost per shirt: $5

Contribution margin per unit = $25 – ($10 + $5) = $10

Contribution margin ratio = $10 / $25 = 0.40 or 40%

This means that for every dollar of sales, 40 cents contributes to covering fixed costs and profit.

Interpreting Contribution Margin: Industry Benchmarks

When it comes to contribution margin, higher is generally better. A higher margin indicates that a larger portion of each sale is available to cover fixed costs and generate profit. However, what constitutes a "good" contribution margin can vary widely depending on the industry, business model, and overall strategy.

Here are some general industry benchmarks for contribution margin ratios:

- Retail: 30-50%

- Manufacturing: 20-40%

- Service industries: 50-70%

- Software and technology: 80-90%

It's important to note that these are general ranges, and individual businesses may fall outside these benchmarks based on their unique circumstances. For example, luxury retailers or high-end service providers may have significantly higher margins, while discount stores or commodity producers may operate with lower margins.

Strategies for Improving Contribution Margin

Enhancing your contribution margin can significantly boost overall profitability. Here are some strategies to consider:

Increase Prices: Carefully raising prices can improve margins, but be mindful of market elasticity and competitive positioning. A study by McKinsey & Company found that a 1% price increase can lead to an 11% profit increase in some industries.

Reduce Variable Costs: Negotiate better deals with suppliers, optimize production processes, or find alternative materials. For example, Dell Computer famously improved its margins by streamlining its supply chain and reducing inventory costs.

Improve Sales Mix: Focus on promoting high-margin products or services. Amazon has successfully used this strategy by pushing its own high-margin private label products.

Increase Sales Volume: Higher volume can lead to economies of scale, potentially reducing per-unit variable costs. Walmart's strategy of high volume, low margin sales exemplifies this approach.

Automate Processes: Reducing labor costs through automation can significantly impact variable costs. For instance, many fast-food chains have introduced self-service kiosks to reduce labor costs and improve margins.

Contribution Margin in Decision-Making

Understanding contribution margin empowers managers to make informed decisions in various areas:

Product Line Decisions: By analyzing the contribution margin of different products, businesses can determine which items to prioritize or potentially discontinue. For example, General Electric used contribution margin analysis to streamline its product portfolio, divesting low-margin businesses to focus on more profitable sectors.

Break-Even Analysis: Contribution margin is a key component in calculating the break-even point – the sales volume at which total revenue equals total costs. This analysis helps businesses understand how many units they need to sell to cover all costs.

Pricing Strategies: Knowing the contribution margin helps in setting competitive yet profitable prices for products or services. Companies like Apple use their high contribution margins to maintain premium pricing strategies.

Resource Allocation: Businesses can allocate resources more efficiently by focusing on high-margin activities. For instance, a consulting firm might use contribution margin analysis to decide which types of projects to pursue or which clients to prioritize.

Advanced Applications: Multi-Product Firms

In businesses with multiple product lines, contribution margin analysis becomes more complex but also more powerful:

Weighted Average Contribution Margin

This concept helps in understanding the overall contribution of a diverse product portfolio:

Weighted Average CM = Σ (Unit CM × Sales Mix %)

For example, a company selling both smartphones and accessories might calculate:

- Smartphones: $200 CM, 60% of sales

- Accessories: $50 CM, 40% of sales

Weighted Average CM = ($200 × 60%) + ($50 × 40%) = $140

This gives a more accurate picture of the overall contribution margin across the product mix.

Contribution Margin Income Statement

This alternative format for income statements emphasizes the separation of variable and fixed costs, providing clearer insights into operational efficiency. Here's a simplified example:

Sales Revenue: $1,000,000

Variable Costs: ($400,000)

--------------------------------

Contribution Margin: $600,000

Fixed Costs: ($450,000)

--------------------------------

Net Operating Income: $150,000

This format clearly shows that 60% of revenue contributes to covering fixed costs and profit.

The Future of Contribution Margin Analysis

As we look towards 2025 and beyond, several trends are shaping the future of contribution margin analysis:

AI and Machine Learning: Advanced algorithms are enabling more sophisticated and real-time margin analysis. For example, Amazon uses AI to dynamically adjust prices and maximize contribution margins across millions of products.

Big Data Integration: The ability to process vast amounts of data is leading to more accurate and nuanced margin calculations. Retailers like Walmart are leveraging big data to optimize pricing and inventory decisions at a granular level.

Dynamic Pricing Models: Contribution margin insights are powering AI-driven pricing strategies that adapt in real-time to market conditions. Airlines and hotels have been at the forefront of this trend, using dynamic pricing to maximize revenue and profitability.

Sustainability Considerations: Companies are increasingly factoring in environmental and social costs into their margin calculations. For instance, Patagonia considers the environmental impact in its pricing and product decisions, which affects its contribution margin calculations.

Blockchain in Cost Tracking: Emerging blockchain technologies are enhancing the accuracy and transparency of cost allocation and margin calculations. Companies like IBM are exploring blockchain for supply chain management, which could revolutionize how variable costs are tracked and analyzed.

Case Studies: Contribution Margin in Action

Tech Giant's Product Line Overhaul

A leading technology company used contribution margin analysis to streamline its product offerings, resulting in a 15% increase in overall profitability within one year. By discontinuing low-margin products and focusing resources on high-margin items, they were able to significantly improve their financial performance.

Retail Chain's Pricing Revolution

A national retail chain implemented dynamic pricing based on contribution margin insights, leading to a 7% increase in gross profit margin across all stores. By adjusting prices in real-time based on demand, competition, and contribution margin data, they were able to optimize their pricing strategy and boost profitability.

Manufacturing Efficiency Boost

A mid-sized manufacturer focused on improving the contribution margin of its top products, resulting in a 20% reduction in variable costs and a significant boost to the bottom line. They achieved this by renegotiating supplier contracts, optimizing production processes, and implementing lean manufacturing principles.

Common Pitfalls and Misconceptions

While contribution margin is a powerful tool, it's important to be aware of potential pitfalls:

Ignoring Fixed Costs: Remember, a high contribution margin doesn't guarantee overall profitability if fixed costs are too high. Always consider the full picture of costs and revenues.

Over-Simplification: Don't rely solely on contribution margin for all decision-making. Consider other factors like market demand, competition, and long-term strategic goals.

Misclassification of Costs: Ensure accurate categorization of variable and fixed costs for reliable calculations. Some costs, like semi-variable expenses, can be particularly tricky to classify correctly.

Short-Term Focus: Avoid sacrificing long-term strategy for short-term margin improvements. For example, cutting quality to reduce variable costs might improve margins in the short term but harm long-term customer satisfaction and brand value.

Conclusion: Harnessing the Power of Contribution Margin

In today's competitive business environment, understanding and leveraging contribution margin is more critical than ever. This powerful metric provides a clear lens through which to view the profitability of products, services, and overall business operations.

By mastering the principles of contribution margin analysis, businesses can:

- Make more informed pricing decisions

- Optimize their product mix

- Improve operational efficiency

- Drive sustainable profitability

As we move into an era of increased data availability and advanced analytics, the role of contribution margin in strategic decision-making will only grow in importance. Forward-thinking managers and business leaders who embrace this concept will be well-positioned to navigate the challenges and opportunities of the evolving business landscape.

Remember, while contribution margin is a powerful tool, it's just one piece of the financial puzzle. Use it in conjunction with other financial metrics and business insights to create a comprehensive strategy for success. By doing so, you'll be well-equipped to drive your business towards greater profitability and long-term sustainability in the dynamic market of 2025 and beyond.