In today's complex and fast-paced business environment, having a deep understanding of financial reporting tools is crucial for success. One of the most important tools in a financial professional's arsenal is the multi-step income statement. This comprehensive guide will explore the intricacies of multi-step income statements, their importance in modern business, and how to leverage them for better decision-making and financial analysis.

What is a Multi-Step Income Statement?

A multi-step income statement is a detailed financial report that provides a comprehensive overview of a company's profitability by separating operating and non-operating activities. Unlike its simpler counterpart, the single-step income statement, the multi-step format offers a more nuanced view of a company's financial performance.

Key Differences from Single-Step Statements

- Detailed breakdown: Multi-step statements offer a more granular view of income and expenses, allowing for deeper analysis.

- Segmentation: They clearly distinguish between operating and non-operating activities, providing insight into core business performance.

- Profitability measures: These statements provide multiple profitability metrics at different stages, such as gross profit, operating income, and net income.

The added detail in a multi-step income statement makes it an indispensable tool for financial reporting, analysis, and decision-making in the modern business landscape.

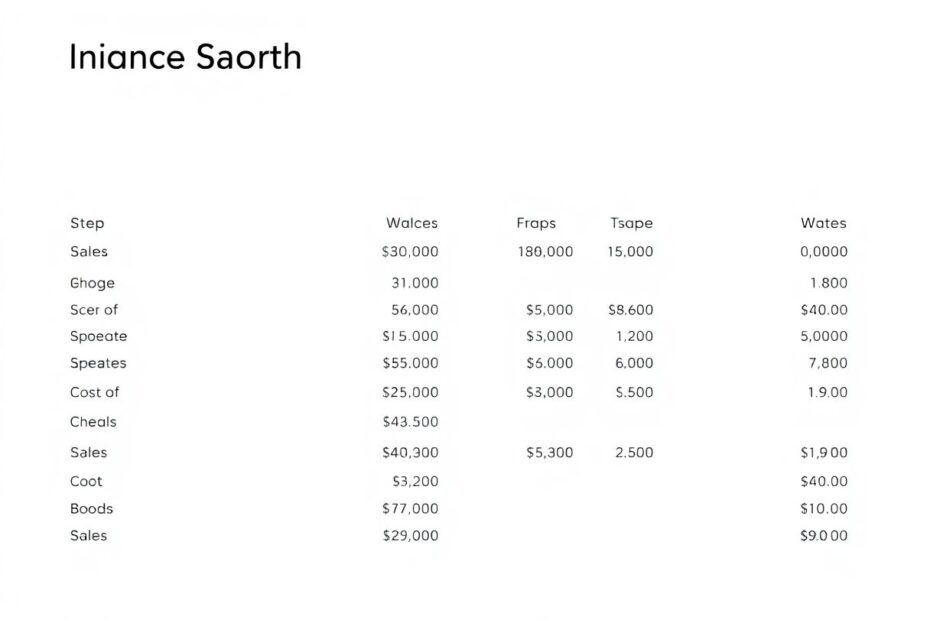

The Structure of a Multi-Step Income Statement

A well-crafted multi-step income statement typically follows this structure:

- Sales or Revenue

- Cost of Goods Sold (COGS)

- Gross Profit

- Operating Expenses

- Operating Income

- Non-Operating Revenues and Expenses

- Income Before Taxes

- Income Tax Expense

- Net Income

Let's break down each component in detail:

1. Sales or Revenue

This is the total amount of money generated from the company's primary business activities. In today's diverse business landscape, many companies have multiple revenue streams. For example, a technology company might report:

- Product sales

- Subscription services

- Licensing fees

- Consulting revenue

It's crucial to provide a clear breakdown of these revenue sources in the income statement.

2. Cost of Goods Sold (COGS)

COGS represents the direct costs associated with producing the goods or services sold by the company. This might include:

- Raw materials

- Direct labor costs

- Manufacturing overhead

For service-based businesses, this section might be called "Cost of Services" and include costs directly related to providing services.

3. Gross Profit

Calculated as Sales minus COGS, gross profit is a crucial metric that shows the profitability of a company's core product or service offerings before accounting for operating expenses. The gross profit margin (gross profit divided by revenue) is a key indicator of a company's pricing strategy and production efficiency.

4. Operating Expenses

These are the costs incurred in the day-to-day running of the business. Common categories include:

- Selling, General, and Administrative expenses (SG&A)

- Research and Development (R&D)

- Depreciation and Amortization

- Marketing and Advertising

- Rent and Utilities

In recent years, many companies have seen shifts in their operating expense structures due to trends like remote work and increased use of technology.

5. Operating Income

Also known as Operating Profit or Earnings Before Interest and Taxes (EBIT), this figure represents the profit generated from the company's core business operations. It's calculated by subtracting operating expenses from gross profit.

6. Non-Operating Revenues and Expenses

This section includes income and expenses not directly related to the company's main operations, such as:

- Interest income or expense

- Gains or losses from investments

- Foreign exchange gains or losses

- One-time extraordinary items

7. Income Before Taxes

This is the sum of operating income and non-operating items, representing the company's profit before accounting for tax obligations.

8. Income Tax Expense

The amount of taxes the company expects to pay on its income. This can be a complex calculation, especially for multinational corporations dealing with various tax jurisdictions.

9. Net Income

Often referred to as the "bottom line," net income represents the company's total profit or loss for the period after all expenses have been accounted for. It's a crucial metric for assessing overall profitability.

Why Use a Multi-Step Income Statement?

1. Enhanced Analysis

Multi-step income statements provide a more detailed view of a company's financial performance, allowing for deeper analysis and better decision-making. By breaking down the profit calculation into multiple steps, analysts can identify specific areas of strength or weakness in the company's operations.

2. Profitability Insights

By separating operating and non-operating activities, these statements offer clearer insights into the core profitability of the business. This is particularly valuable for assessing the effectiveness of management in running the company's primary operations.

3. Compliance and Transparency

For publicly traded companies, multi-step income statements are often required for regulatory compliance, particularly in adherence to Generally Accepted Accounting Principles (GAAP) in the United States. They provide transparency to investors, helping them make informed decisions.

4. Benchmarking

The detailed breakdown allows for easier comparison with industry peers and historical performance. This is crucial for both internal performance assessment and external competitive analysis.

5. Facilitates Ratio Analysis

The structure of multi-step income statements makes it easier to calculate various financial ratios, such as gross margin, operating margin, and net profit margin. These ratios are essential for assessing a company's financial health and efficiency.

Real-World Applications

Tech Industry Example

In the rapidly evolving tech sector, multi-step income statements are increasingly used to showcase diverse revenue streams:

- Cloud Services Revenue

- Hardware Sales

- Software Licensing

- Consulting Services

This breakdown helps investors understand which segments are driving growth and profitability. For instance, a company might show strong growth in cloud services revenue while hardware sales decline, indicating a strategic shift in the business model.

E-commerce Sector

E-commerce giants are using multi-step statements to highlight:

- Marketplace revenue vs. Direct sales revenue

- Fulfillment costs as a key component of COGS

- Technology and content expenses as significant operating costs

This level of detail is crucial in the e-commerce sector, where understanding the balance between various revenue streams and the costs associated with fulfillment and technology infrastructure is key to assessing a company's competitive position.

Manufacturing Industry

For manufacturing companies, multi-step income statements can provide valuable insights into:

- Raw material costs vs. labor costs within COGS

- Efficiency of production through gross margin analysis

- Impact of research and development on overall profitability

Service-Based Businesses

Professional service firms, such as consulting or law practices, can use multi-step income statements to:

- Break down revenue by service type or client industry

- Analyze the impact of billable hours vs. non-billable time

- Assess the profitability of different service lines

Advanced Analytical Techniques

Margin Analysis

Multi-step income statements facilitate various margin calculations:

- Gross Margin = (Gross Profit / Revenue) x 100

- Operating Margin = (Operating Income / Revenue) x 100

- Net Profit Margin = (Net Income / Revenue) x 100

These metrics provide valuable insights into a company's efficiency and profitability at different levels. For example, a high gross margin but low operating margin might indicate efficient production but high overhead costs.

Trend Analysis

By comparing multi-step income statements over multiple periods, analysts can identify trends in:

- Revenue growth

- Cost management

- Profitability improvements

This longitudinal analysis is crucial for understanding a company's financial trajectory and the effectiveness of its strategies over time.

Segment Reporting

For companies with multiple business lines, multi-step income statements can be broken down by segment, offering insights into the performance of each division. This is particularly valuable for conglomerates or companies with diverse product lines.

Contribution Margin Analysis

The multi-step format allows for easy calculation of contribution margin (revenue minus variable costs), which is crucial for break-even analysis and making decisions about product lines or pricing strategies.

Challenges and Considerations

1. Complexity

While multi-step income statements offer more detail, they can be more complex to prepare and interpret, especially for smaller businesses or those without sophisticated accounting systems.

2. Potential for Manipulation

The detailed nature of these statements can sometimes provide opportunities for creative accounting. It's crucial to maintain strict adherence to accounting principles and ensure proper oversight and auditing.

3. Evolving Standards

As financial reporting standards continue to evolve, companies must stay updated on the latest requirements for multi-step income statements. This may involve ongoing training for finance teams and regular reviews of reporting practices.

4. Data Management

Generating accurate multi-step income statements requires robust data management systems to track and categorize various income and expense items correctly.

The Future of Multi-Step Income Statements

Looking ahead, several trends are likely to shape the future of multi-step income statements:

Integration of Non-Financial Metrics: There's a growing trend towards incorporating Environmental, Social, and Governance (ESG) metrics and other non-financial performance indicators into financial reporting. Future multi-step income statements might include sections dedicated to sustainability costs or social impact investments.

Real-Time Reporting: Advancements in financial technology may enable more frequent or even real-time multi-step income statement generation. This could provide stakeholders with more up-to-date financial information for decision-making.

AI-Driven Analysis: Artificial intelligence and machine learning tools will likely play a larger role in analyzing and deriving insights from these detailed statements. This could include automated trend detection, anomaly identification, and predictive analytics.

Blockchain Integration: Some companies may begin using blockchain technology to enhance the transparency and verifiability of their financial reporting. This could provide an immutable record of transactions and calculations leading to the final income statement.

Customization and Interactivity: Digital reporting formats may allow for more interactive multi-step income statements, where users can drill down into specific line items for additional detail or customize the view based on their analytical needs.

Global Standardization: As international business continues to grow, there may be increased efforts to standardize multi-step income statement formats across different accounting standards (e.g., GAAP and IFRS) to facilitate easier global comparisons.

Best Practices for Preparing Multi-Step Income Statements

Ensure Accuracy: Double-check all calculations and ensure that the statement balances. Use accounting software to minimize human error.

Maintain Consistency: Use consistent categories and line items from period to period to facilitate accurate comparisons.

Provide Clear Labels: Ensure all line items are clearly labeled and, where necessary, include notes to explain any unusual items or calculations.

Include Comparative Data: Present data from multiple periods (e.g., current year and previous year) side by side for easy comparison.

Use Appropriate Level of Detail: Strike a balance between providing enough detail for meaningful analysis and avoiding information overload.

Align with Accounting Standards: Ensure your multi-step income statement complies with relevant accounting standards (GAAP or IFRS).

Leverage Technology: Use advanced accounting and financial reporting software to streamline the preparation process and reduce errors.

Conclusion

The multi-step income statement remains a cornerstone of financial reporting, offering unparalleled insights into a company's financial performance. As businesses continue to evolve in complexity and scope, the ability to accurately prepare and analyze these statements becomes ever more crucial.

For financial professionals, business owners, and investors alike, mastering the multi-step income statement is not just about compliance or number-crunching—it's about gaining a deeper understanding of a company's financial health and future prospects. By leveraging the detailed information provided in these statements, stakeholders can make more informed decisions, drive strategic initiatives, and ultimately contribute to the long-term success of their organizations.

In an era of rapid technological advancement and changing business models, the multi-step income statement stands as a reliable, comprehensive tool for financial analysis and decision-making. Its continued relevance and adaptability ensure that it will remain an indispensable part of the financial landscape for years to come.

As we move forward, the key to success will lie in not just understanding how to prepare these statements, but in developing the analytical skills to derive meaningful insights from them. By combining traditional financial acumen with emerging technologies and a forward-thinking approach, businesses can use multi-step income statements as a powerful tool for navigating the complexities of the modern economic landscape.